Critical Illness Insurance Services

Protection Beyond Provincial Health Coverage

While Canadian healthcare covers your medical treatment, it doesn’t cover the financial impact of a serious illness. Time off work, out-of-pocket expenses, experimental treatments, and lifestyle adjustments can drain your savings when you need them most.

Critical illness insurance provides a lump-sum payment when you’re diagnosed with a covered condition, giving you financial breathing room to focus on recovery rather than bills.

Understanding Critical Illness Coverage

Standard Critical Illness Plans

Core protection covering major conditions like cancer, heart attack, and stroke. These three conditions account for the majority of critical illness claims in Canada and provide essential coverage most families need.

Comprehensive Critical Illness Plans

Extended coverage including up to 25+ conditions such as kidney failure, major organ transplant, paralysis, and blindness. Ideal for those seeking broader protection against a wider range of serious health events.

Child Critical Illness Insurance

Specialized coverage protecting your children against serious childhood illnesses. Ensures you can take time off work to care for your child without financial stress, and covers expenses that provincial health plans don’t.

Return of Premium Options

Plans that refund your premiums if you don’t make a claim, typically after 15 or 20 years. Eliminates the “use it or lose it” concern many people have about insurance.

Questions We Help You Navigate

- Which medical conditions are covered under different policy types?

- How much coverage should I carry to maintain my lifestyle during recovery?

- What's the difference between critical illness and disability insurance?

- Can I get coverage if I have pre-existing conditions or family history?

- How quickly are claims paid after diagnosis?

- Should I add critical illness riders to my life insurance or buy a separate policy?

Planning for the Unexpected

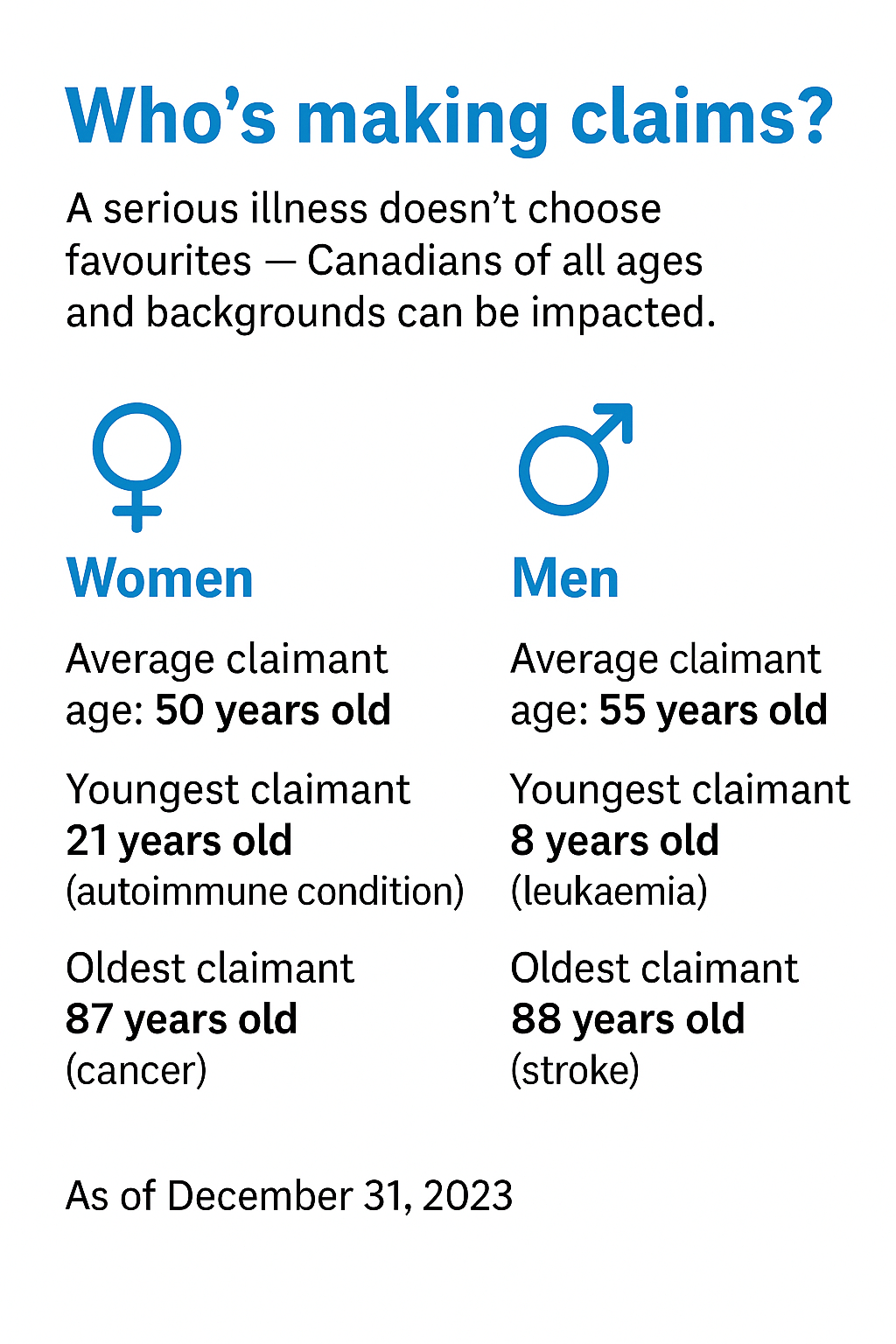

Critical illness strikes Canadian families every day, often without warning. One in two Canadians will be diagnosed with cancer in their lifetime, and cardiovascular disease remains a leading health concern across all age groups.

We'll sit down with you to understand your health history, family medical background, and financial obligations. Together, we'll design a critical illness strategy that provides meaningful protection without overextending your budget.

Critical Illness Insurance Services in Surrey, BC

Our Surrey practice works with individuals and families throughout BC who want to safeguard their finances against serious health challenges. We understand the unique healthcare landscape in our province and help you supplement your provincial coverage appropriately.

Whether you're a young professional just starting out or approaching retirement with accumulated assets to protect, we'll find coverage that makes sense for your stage of life.

Contact Us

Rick Singh - Founder

Retire with confidence